How Much Is All Money In United State

| U.s.a. dollar | |||||

|---|---|---|---|---|---|

| |||||

| ISO 4217 | |||||

| Lawmaking | USD | ||||

| Number | 840 | ||||

| Exponent | ii | ||||

| Denominations | |||||

| Superunit | |||||

| x | Eagle | ||||

| Subunit | |||||

| 1⁄10 | Dime | ||||

| 1⁄100 | Cent | ||||

| 1⁄1000 | Mill | ||||

| Symbol | $, US$, U$ | ||||

| Cent | ¢ | ||||

| Mill | ₥ | ||||

| Nickname | List of nicknames

| ||||

| Banknotes | |||||

| Freq. used | $1, $5, $x, $20, $l, $100 | ||||

| Rarely used | $2 (still printed); $500, $1,000, $5,000, $ten,000 (discontinued, still legal tender) | ||||

| Coins | |||||

| Freq. used | ane¢, 5¢, ten¢, 25¢ | ||||

| Rarely used | 50¢, $1 (all the same minted); ½¢ two¢, 3¢ (Nickel); 3¢ (argent, discontinued but still legal tender); 20¢, $two.50, $3, $20 (discontinued, however legal tender); $five, $x (legal tender, now commemorative only) | ||||

| Demographics | |||||

| Date of introduction | April 2, 1792 (1792-04-02) | ||||

| Source | [1] | ||||

| Replaced | Continental currency Various strange currencies, including: Pound sterling Castilian dollar | ||||

| User(s) | ix dependent territories

viii other countries

| ||||

| Issuance | |||||

| Fundamental bank | Federal Reserve | ||||

| Website | federalreserve | ||||

| Printer | Bureau of Engraving and Printing | ||||

| Website | moneyfactory | ||||

| Mint | U.s. Mint | ||||

| Website | usmint | ||||

| Valuation | |||||

| Inflation | viii.5% | ||||

| Source | BLS, March 2022 | ||||

| Method | CPI | ||||

| Pegged by | 35 currencies

| ||||

The United States dollar (symbol: $; lawmaking: USD; too abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.Due south. dollar, American dollar, or colloquially buck) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.South. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly chosen greenbacks due to their predominantly green color.

The monetary policy of the Usa is conducted by the Federal Reserve System, which acts as the nation's central bank.

The U.Southward. dollar was originally defined under a bimetallic standard of 371.25 grains (24.057 one thousand) (0.7735 troy ounces) fine silver or, from 1837, 23.22 grains (1.505 g) fine gold, or $20.67 per troy ounce. The Gold Standard Deed of 1900 linked the dollar solely to gold. From 1934, its equivalence to gilded was revised to $35 per troy ounce. Since 1971 all links to golden have been repealed.[seven]

The U.S. dollar became an important international reserve currency after the Start World State of war, and displaced the pound sterling as the world's principal reserve currency past the Bretton Wood Agreement towards the stop of the Second World State of war. The dollar is the most widely used currency in international transactions,[8] and a free-floating currency. It is also the official currency in several countries and the de facto currency in many others,[9] [x] with Federal Reserve Notes (and, in a few cases, U.Southward. coins) used in circulation.

Equally of February ten, 2021, currency in circulation amounted to Usa$2.10 trillion, $2.05 trillion of which is in Federal Reserve Notes (the remaining $fifty billion is in the form of coins and older-mode United States Notes).[11]

Overview [edit]

In the Constitution [edit]

Article I, Section 8 of the U.S. Constitution provides that Congress has the power "[t]o money money."[12] Laws implementing this power are currently codified in Championship 31 of the U.S. Code, under Section 5112, which prescribes the forms in which the Usa dollars should exist issued.[thirteen] These coins are both designated in the section as "legal tender" in payment of debts.[13] The Sacagawea dollar is one example of the copper alloy dollar, in contrast to the American Silver Eagle which is pure silvery. Section 5112 besides provides for the minting and issuance of other coins, which have values ranging from one cent (U.Southward. Penny) to 100 dollars.[13] These other coins are more fully described in Coins of the United States dollar.

Commodity I, Section 9 of the Constitution provides that "a regular Statement and Account of the Receipts and Expenditures of all public Money shall exist published from time to time,"[14] which is further specified past Section 331 of Title 31 of the U.S. Code.[15] The sums of money reported in the "Statements" are currently expressed in U.South. dollars, thus the U.S. dollar may exist described equally the unit of account of the United States.[16] "Dollar" is i of the commencement words of Section 9, in which the term refers to the Castilian milled dollar, or the coin worth eight Spanish reales.

The Coinage Act [edit]

In 1792, the U.S. Congress passed the Coinage Act, of which Department 9 authorized the production of various coins, including:[17] : 248

Dollars or Units—each to exist of the value of a Spanish milled dollar as the aforementioned is now current, and to contain three hundred and seventy-1 grains and 4 sixteenth parts of a grain of pure, or four hundred and sixteen grains of standard silver.

Section 20 of the Human activity designates the United states of america dollar as the unit of currency of the United States:[17] : 250–i

[T]he money of account of the United states shall exist expressed in dollars, or units…and that all accounts in the public offices and all proceedings in the courts of the The states shall be kept and had in conformity to this regulation.

Decimal units [edit]

Unlike the Castilian milled dollar, the Continental Congress and the Coinage Human activity prescribed a decimal system of units to go with the unit dollar, every bit follows:[18] [nineteen] the factory, or one-thousandth of a dollar; the cent, or one-hundredth of a dollar; the dime, or i-tenth of a dollar; and the hawkeye, or ten dollars. The current relevance of these units:

- Only the cent (¢) is used equally everyday division of the dollar.

- The dime is used solely every bit the name of the money with the value of ten cents.

- The mill (₥) is relatively unknown, merely before the mid-20th century was familiarly used in matters of sales taxes, likewise equally gasoline prices, which are commonly in the grade of $ΧΧ.ΧΧ9 per gallon (e.thousand., $iii.599, unremarkably written as $3.59+ 9⁄10 ).[20] [21]

- The eagle is also largely unknown to the full general public.[21] This term was used in the Coinage Act of 1792 for the denomination of ten dollars, and subsequently was used in naming golden coins.

The Castilian peso or dollar was historically divided into 8 reales (colloquially, bits) - hence pieces of eight. Americans besides learned counting in not-decimal $.25 of 12 one⁄2 cents earlier 1857 when Mexican $.25 were more oftentimes encountered than American cents; in fact this practice survived in New York Stock Exchange quotations until 2001.[22] [23]

In 1854, Secretary of the Treasury James Guthrie proposed creating $100, $50, and $25 golden coins, to exist referred to as a spousal relationship, half marriage, and quarter matrimony, respectively,[24] thus implying a denomination of 1 Matrimony = $100. However, no such coins were always struck, and merely patterns for the $l one-half union exist.

When currently issued in circulating form, denominations less than or equal to a dollar are emitted as U.S. coins, while denominations greater than or equal to a dollar are emitted as Federal Reserve Notes, disregarding these special cases:

- Gold coins issued for apportionment until the 1930s, up to the value of $xx (known as the double hawkeye)

- Bullion or commemorative gilt, silvery, platinum, and palladium coins valued up to $100 every bit legal tender (though worth far more as bullion).

- Civil War paper currency upshot in denominations below $1, i.e. partial currency, sometimes pejoratively referred to as shinplasters.

Etymology [edit]

In the 16th century, Count Hieronymus Schlick of Bohemia began minting coins known as joachimstalers, named for Joachimstal, the valley in which the silver was mined. In turn, the valley's name is titled subsequently Saint Joachim, whereby thal or tal, a cognate of the English word dale, is German for 'valley.'[25] The joachimstaler was later shortened to the German language taler, a word that eventually found its fashion into many languages, including:[25] tolar (Czech, Slovak and Slovene); daler (Danish and Swedish); dalar and daler (Norwegian); daler or daalder (Dutch); talari (Ethiopian); tallér (Hungarian); tallero (Italian); دولار (Arabic); and dollar (English).

Though the Dutch pioneered in modern-twenty-four hour period New York in the 17th century the use and the counting of money in silver dollars in the course of High german-Dutch reichsthalers and native Dutch leeuwendaalders ('lion dollars'), it was the ubiquitous Spanish American eight-real coin which became exclusively known equally the dollar since the 18th century.[26]

Nicknames [edit]

The colloquialism buck(s) (much like the British quid for the pound sterling) is oftentimes used to refer to dollars of diverse nations, including the U.S. dollar. This term, dating to the 18th century, may have originated with the colonial leather trade, or it may also accept originated from a poker term.[27]

Greenback is another nickname, originally applied specifically to the 19th-century Demand Note dollars, which were printed black and greenish on the backside, created by Abraham Lincoln to finance the North for the Civil War.[28] It is nevertheless used to refer to the U.S. dollar (but not to the dollars of other countries). The term greenback is as well used past the financial press in other countries, such as Commonwealth of australia,[29] New Zealand,[30] South Africa,[31] and Republic of india.[32]

Other well-known names of the dollar equally a whole in denominations include greenmail , dark-green , and dead presidents , the latter of which referring to the deceased presidents pictured on near bills. Dollars in general have also been known as bones (e.one thousand. "20 bones" = $20). The newer designs, with portraits displayed in the main trunk of the obverse (rather than in cameo insets), upon newspaper colour-coded by denomination, are sometimes referred to as bigface notes or Monopoly money .

Piastre was the original French discussion for the U.S. dollar, used for example in the French text of the Louisiana Purchase. Though the U.S. dollar is called dollar in Mod French, the term piastre is still used among the speakers of Cajun French and New England French, likewise equally speakers in Haiti and other French-speaking Caribbean islands.

Nicknames specific to denomination:

- The quarter dollar coin is known as two bits, betraying the dollar'south origins as the "piece of eight" (bits or reales).[22]

- The $one nib is nicknamed cadet or unmarried.

- The infrequently-used $2 bill is sometimes chosen deuce, Tom, or Jefferson (after Thomas Jefferson).

- The $v bill is sometimes called Lincoln, fin, fiver, or five-spot.

- The $10 bill is sometimes chosen sawbuck, ten-spot, or Hamilton (after Alexander Hamilton).

- The $20 bill is sometimes called double sawbuck, Jackson (later on Andrew Jackson), or double hawkeye.

- The $l bill is sometimes chosen a yardstick, or a grant, subsequently President Ulysses Due south. Grant.

- The $100 bill is chosen Benjamin, Benji, Ben, or Franklin, referring to its portrait of Benjamin Franklin. Other nicknames include C-annotation (C being the Roman numeral for 100), century annotation, or bill (eastward.grand. two bills = $200).

- Amounts or multiples of $1,000 are sometimes chosen grand in colloquial voice communication, abbreviated in written form to G, Thou, or yard (from kilo; e.g. $10k = $x,000). As well, a large or stack can also refer to a multiple of $1,000 (due east.g. "l large" = $50,000).

Dollar sign [edit]

The symbol $, commonly written earlier the numerical amount, is used for the U.Southward. dollar (too as for many other currencies). The sign was the issue of a late 18th-century evolution of the scribal abbreviation ps for the peso, the common name for the Spanish dollars that were in broad apportionment in the New Earth from the 16th to the 19th centuries. The p and the s eventually came to be written over each other giving rise to $ .[33] [34] [35] [36]

Another popular explanation is that it is derived from the Pillars of Hercules on the Castilian Coat of arms of the Castilian dollar. These Pillars of Hercules on the silver Spanish dollar coins take the form of two vertical bars (||) and a swinging cloth band in the shape of an Southward .

Yet another explanation suggests that the dollar sign was formed from the upper-case letter letters U and S written or printed one on top of the other. This theory, popularized by novelist Ayn Rand in Atlas Shrugged,[37] does not consider the fact that the symbol was already in utilize before the formation of the United States.[38]

History [edit]

Origins: the Spanish dollar [edit]

The U.S. dollar was introduced at par with the Spanish-American silvery dollar (or Spanish peso, Spanish milled dollar, eight-real coin, piece-of-eight). The latter was produced from the rich silvery mine output of Spanish America; minted in Mexico City, Potosí (Bolivia), Lima (Peru) and elsewhere; and was in broad circulation throughout the Americas, Asia and Europe from the 16th to 19th centuries. The minting of machine-milled Castilian dollars since 1732 additional its worldwide reputation equally a trade coin and positioned it to be model for the new currency of the The states.

Even subsequently the U.s.a. Mint commenced issuing coins in 1792, locally minted dollars and cents were less abundant in apportionment than Spanish American pesos and reales; hence Spanish, Mexican and American dollars all remained legal tender in the United States until the Coinage Act of 1857. In particular, Colonists' familiarity with the Castilian 2-real quarter peso was the reason for issuing a quasi-decimal 25-cent quarter dollar coin rather than a 20-cent coin.

For the relationship between the Spanish dollar and the private state colonial currencies, see Connecticut pound, Delaware pound, Georgia pound, Maryland pound, Massachusetts pound, New Hampshire pound, New Jersey pound, New York pound, N Carolina pound, Pennsylvania pound, Rhode Island pound, Southward Carolina pound, and Virginia pound.

Coinage Act of 1792 [edit]

Alexander Hamilton finalized the details of the 1792 Coinage Act and the establishment of the U.S. Mint.

On the 6th of July 1785, the Continental Congress resolved that the money unit of the United States, the dollar, would contain 375.64 grains of fine silvery; on the 8th of August 1786, the Continental Congress continued that definition and further resolved that the money of business relationship, respective with the sectionalisation of coins, would proceed in a decimal ratio, with the sub-units being mills at 0.001 of a dollar, cents at 0.010 of a dollar, and dimes at 0.100 of a dollar.[18]

After the adoption of the Usa Constitution, the U.South. dollar was defined by the Coinage Human action of 1792. It specified a "dollar" based on the Spanish milled dollar to incorporate 371 4⁄sixteen grains of fine argent, or 416.0 grains (26.96 m) of "standard silver" of fineness 371.25/416 = 89.24%; also as an "eagle" to contain 247 iv⁄viii grains of fine golden, or 270.0 grains (17.fifty one thousand) of 22 karat or 91.67% fine gold.[39] Alexander Hamilton arrived at these numbers based on a treasury assay of the boilerplate fine silvery content of a pick of worn Spanish dollars, which came out to be 371 grains. Combined with the prevailing aureate-silver ratio of 15, the standard for gold was calculated at 371/15 = 24.73 grains fine aureate or 26.98 grains 22K gold. Rounding the latter to 27.0 grains finalized the dollar's standard to 24.75 grains of fine gilt or 24.75*15 = 371.25 grains = 24.0566 grams = 0.7735 troy ounces of fine silver.

The aforementioned coinage act also set the value of an hawkeye at 10 dollars, and the dollar at 1⁄10 hawkeye. It chosen for silver coins in denominations of 1, 1⁄two , 1⁄4 , one⁄ten , and ane⁄xx dollar, likewise as aureate coins in denominations of i, i⁄2 and i⁄four eagle. The value of aureate or silver contained in the dollar was then converted into relative value in the economic system for the buying and selling of goods. This immune the value of things to remain fairly constant over time, except for the influx and outflux of gold and silverish in the nation's economic system.[forty]

Though a Castilian dollar freshly minted later 1772 theoretically contained 417.seven grains of silver of fineness 130/144 (or 377.ane grains fine silver), reliable assays of the flow in fact confirmed a fine silver content of 370.95 grains (24.037 g) for the average Spanish dollar in circulation. [41] The new U.South. silverish dollar of 371.25 grains (24.057 grand) therefore compared favorably and was received at par with the Spanish dollar for strange payments, and afterwards 1803 the United States Mint had to suspend making this coin out of its limited resources since it failed to stay in domestic apportionment. It was just after Mexican independence in 1821 when their peso's fine silver content of 377.i grains was firmly upheld, which the U.S. after had to compete with using a heavier 378.0 grains (24.49 g) Trade dollar money.

Design [edit]

The early currency of the United States did not showroom faces of presidents, every bit is the custom now;[42] although today, by police, only the portrait of a deceased individual may announced on U.s.a. currency.[43] In fact, the newly formed government was against having portraits of leaders on the currency, a exercise compared to the policies of European monarchs.[44] The currency as nosotros know it today did not get the faces they currently have until after the early on 20th century; before that "heads" side of coinage used profile faces and striding, seated, and standing figures from Greek and Roman mythology and composite Native Americans. The last coins to be converted to profiles of historic Americans were the dime (1946) and the Dollar (1971).

Continental currency [edit]

Continental one third dollar pecker (obverse)

Afterward the American Revolution, the thirteen colonies became independent. Freed from British monetary regulations, they each issued £sd paper money to pay for military expenses. The Continental Congress also began issuing "Continental Currency" denominated in Spanish dollars. For its value relative to states' currencies, see Early American currency.

Continental currency depreciated badly during the war, giving rise to the famous phrase "non worth a continental".[45] A primary problem was that budgetary policy was not coordinated between Congress and the states, which continued to result bills of credit. Additionally, neither Congress nor the governments of the several states had the will or the means to retire the bills from apportionment through tax or the sale of bonds.[46] The currency was ultimately replaced past the silver dollar at the rate of ane silver dollar to 1000 continental dollars. It gave rise to the phrase "not worth a continental", and was responsible for the clause in commodity 1, department 10 of the The states Constitution which reads: "No state shall... make anything but gilded and silverish coin a tender in payment of debts".

Silver and golden standards, 19th century [edit]

From implementation of the 1792 Mint Act to the 1900 implementation of the aureate standard the dollar was on a bimetallic silver-and-gold standard, defined as either 371.25 grains (24.056 g) of fine silvery or 24.75 grains of fine gold (gold-silver ratio 15).

Subsequent to the Coinage Human action of 1834 the dollar'southward fine golden equivalent was revised to 23.ii grains; information technology was slightly adjusted to 23.22 grains (i.505 grand) in 1837 (golden-silvery ratio ~16). The same human action also resolved the difficulty in minting the "standard silver" of 89.24% fineness past revising the dollar's alloy to 412.5 grains, 90% silver, still containing 371.25 grains fine silver. Gold was also revised to 90% fineness: 25.8 grains gross, 23.22 grains fine gold.

Following the rising in the price of argent during the California Gold Rush and the disappearance of circulating silver coins, the Coinage Act of 1853 reduced the standard for silver coins less than $i from 412.5 grains to 384 grains (24.9 one thousand), 90% silverish per 100 cents (slightly revised to 25.0 1000, 90% silverish in 1873). The Human activity as well limited the gratis silver right of individuals to catechumen bullion into only i coin, the silver dollar of 412.5 grains; smaller coins of lower standard tin can simply be produced past the United States Mint using its own bullion.

Summary and links to coins issued in the 19th century:

- In base of operations metal: 1/2 cent, one cent, 5 cents.

- In silver: half dime, dime, quarter dollar, half dollar, silverish dollar.

- In gold: gold $ane, $2.l quarter hawkeye, $5 half hawkeye, $10 eagle, $20 double hawkeye

- Less common denominations: statuary ii cents, nickel 3 cents, silver 3 cents, argent 20 cents, gold $3.

Notation issues, 19th century [edit]

In order to finance the State of war of 1812, Congress authorized the issuance of Treasury Notes, interest-bearing short-term debt that could be used to pay public dues. While they were intended to serve as debt, they did function "to a express extent" as money. Treasury Notes were again printed to assist resolve the reduction in public revenues resulting from the Panic of 1837 and the Panic of 1857, besides as to assist finance the Mexican–American War and the Civil State of war.

Newspaper money was issued again in 1862 without the bankroll of precious metals due to the Ceremonious War. In add-on to Treasury Notes, Congress in 1861 authorized the Treasury to borrow $l one thousand thousand in the class of Demand Notes, which did not behave involvement but could be redeemed on need for precious metals. However, by December 1861, the Union government'south supply of specie was outstripped by need for redemption and they were forced to suspend redemption temporarily. In February 1862 Congress passed the Legal Tender Act of 1862, issuing U.s.a. Notes, which were not redeemable on demand and diameter no interest, merely were legal tender, meaning that creditors had to accept them at face value for any payment except for public debts and import tariffs. However, silver and gold coins continued to exist issued, resulting in the depreciation of the newly printed notes through Gresham's Law. In 1869, Supreme Court ruled in Hepburn v. Griswold that Congress could not require creditors to accept United States Notes, simply overturned that ruling the adjacent yr in the Legal Tender Cases. In 1875, Congress passed the Specie Payment Resumption Act, requiring the Treasury to allow U.S. Notes to be redeemed for golden after January i, 1879.

Gilt standard, 20th century [edit]

Though the dollar came nether the gold standard de jure merely later 1900, the bimetallic era was ended de facto when the Coinage Act of 1873 suspended the minting of the standard silverish dollar of 412.5 grains (26.73 g = 0.8595 oz t), the only fully legal tender coin that individuals could catechumen bullion into in unlimited (or Costless silvery) quantities,[47] and right at the onset of the silver blitz from the Comstock Lode in the 1870s. This was the so-chosen "Crime of '73".

The Gold Standard Act of 1900 repealed the U.S. dollar'due south historic link to argent and defined it solely equally 23.22 grains (1.505 g) of fine gold (or $20.67 per troy ounce of 480 grains). In 1933, gold coins were confiscated by Executive Order 6102 nether Franklin D. Roosevelt, and in 1934 the standard was inverse to $35 per troy ounce fine golden, or 13.71 grains (0.888 thou) per dollar.

After 1968 a series of revisions to the gold peg was implemented, culminating in the Nixon Daze of August 15, 1971, which suddenly concluded the convertibility of dollars to gilded. The U.S. dollar has since floated freely on the foreign exchange markets.

Federal Reserve Notes, 20th century to present [edit]

Obverse of a rare 1934 $500 Federal Reserve Annotation, featuring a portrait of President William McKinley

Reverse of a $500 Federal Reserve Annotation

Congress continued to issue paper money afterwards the Civil State of war, the latest of which is the Federal Reserve Note that was authorized past the Federal Reserve Human activity of 1913. Since the discontinuation of all other types of notes (Gilded Certificates in 1933, Silver Certificates in 1963, and United States Notes in 1971), U.S. dollar notes have since been issued exclusively equally Federal Reserve Notes.

Emergence as reserve currency [edit]

The U.Southward. dollar first emerged as an important international reserve currency in the 1920s, displacing the British pound sterling as it emerged from the Offset World War relatively unscathed and since the U.s.a. was a significant recipient of wartime aureate inflows. Afterward the United States emerged every bit an even stronger global superpower during the 2nd World War, the Bretton Woods Agreement of 1944 established the U.S. dollar as the world'due south primary reserve currency and the merely post-war currency linked to aureate. Despite all links to gold being severed in 1971, the dollar continues to be the world's foremost reserve currency for international trade to this day.

The Bretton Woods Agreement of 1944 also defined the postal service-World War Two monetary order and relations among modern-day independent states, by setting up a organisation of rules, institutions, and procedures to regulate the international monetary system. The agreement founded the International Budgetary Fund and other institutions of the mod-day World Bank Group, establishing the infrastructure for conducting international payments and accessing the global capital markets using the U.S. dollar.

The monetary policy of the United States is conducted past the Federal Reserve Arrangement, which acts as the nation'southward central bank. Information technology was founded in 1913 nether the Federal Reserve Act in lodge to furnish an elastic currency for the United States and to supervise its banking arrangement, peculiarly in the aftermath of the Panic of 1907.

For most of the post-war flow, the U.Due south. government has financed its ain spending by borrowing heavily from the dollar-lubricated global upper-case letter markets, in debts denominated in its own currency and at minimal interest rates. This power to borrow heavily without facing a significant balance of payments crunch has been described as the United States's exorbitant privilege.

Coins [edit]

The The states Mint has issued legal tender coins every year from 1792 to the present. From 1934 to the present, the only denominations produced for circulation take been the familiar penny, nickel, dime, quarter, half dollar, and dollar.

| Denomination | Common name | Obverse | Contrary | Obverse portrait and blueprint date | Contrary motif and pattern date | Weight | Diameter | Fabric | Border | Apportionment |

|---|---|---|---|---|---|---|---|---|---|---|

| Cent i¢ | penny |  | Abraham Lincoln (1909) | Union Shield (2010) | 2.5 thou (0.088 oz) | 0.75 in (19.05 mm) | 97.5% Zn covered by 2.5% Cu | Obviously | Wide | |

| Five cents 5¢ | nickel |  | Thomas Jefferson (2006) | Monticello (1938) | 5.0 thou (0.176 oz) | 0.835 in (21.21 mm) | 75% Cu 25% Ni | Plain | Wide | |

| Dime 10¢ | dime |  |  | Franklin D. Roosevelt (1946) | Olive branch, torch, and oak branch (1946) | ii.268 g (0.08 oz) | 0.705 in (17.91 mm) | 91.67% Cu 8.33% Ni | 118 reeds | Broad |

| Quarter dollar 25¢ | quarter |  | George Washington (1932) | Washington crossing the Delaware (2021) | 5.67 g (0.2 oz) | 0.955 in (24.26 mm) | 91.67% Cu 8.33% Ni | 119 reeds | Wide | |

| One-half dollar fifty¢ | one-half |  |  | John F. Kennedy (1964) | Presidential Seal (1964) | eleven.34 chiliad (0.four oz) | 1.205 in (30.61 mm) | 91.67% Cu 8.33% Ni | 150 reeds | Limited |

| Dollar coin $1 | dollar coin, gilt dollar |  | Profile of Sacagawea with her child | Various; new design per twelvemonth | 8.10 g (0.286 oz) | 1.043 in (26.50 mm) | 88.five% Cu vi% Zn 3.5% Mn 2% Ni | Obviously 2000-2006 Lettered 2007-Present | Limited |

Gilt and silvery coins accept been previously minted for general circulation from the 18th to the 20th centuries. The final gold coins were minted in 1933. The last ninety% argent coins were minted in 1964, and the last 40% silver one-half dollar was minted in 1970.

The United states of america Mint currently produces circulating coins at the Philadelphia and Denver Mints, and commemorative and proof coins for collectors at the San Francisco and W Point Mints. Mint mark conventions for these and for by mint branches are discussed in Coins of the United states dollar#Mint marks.

The 1-dollar money has never been in pop circulation from 1794 to nowadays, despite several attempts to increase their usage since the 1970s, the nigh important reason of which is the continued production and popularity of the one-dollar bill.[48] One-half dollar coins were normally used currency since inception in 1794, simply has fallen out of employ from the mid-1960s when all silver half dollars began to be hoarded.

The nickel is the only coin whose size and composition (5 grams, 75% copper, and 25% nickel) is still in utilize from 1865 to today, except for wartime 1942-1945 Jefferson nickels which contained silver.

Due to the penny's low value, some efforts take been made to eliminate the penny as circulating coinage. [49] [50]

For a discussion of other discontinued and canceled denominations, encounter Obsolete denominations of U.s. currency#Coinage and Canceled denominations of United States currency#Coinage.

Collector coins [edit]

Collector coins are technically legal tender at confront value only are usually worth far more due to their numismatic value or for their precious metal content. These include:

- American Eagle bullion coins

- American Argent Eagle $1 (one troy oz) Silver bullion coin 1986–present

- American Aureate Hawkeye $5 ( one⁄10 troy oz), $ten ( 1⁄4 troy oz), $25 ( ane⁄two troy oz), and $fifty (1 troy oz) Gold bullion coin 1986–present

- American Platinum Eagle $ten ( 1⁄ten troy oz), $25 ( one⁄4 troy oz), $50 ( one⁄2 troy oz), and $100 (one troy oz) Platinum bullion coin 1997–present

- American Palladium Eagle $25 (1 troy oz) Palladium bullion coin 2017–present

- United states of america commemorative coins—special issue coins, among these:

- $50.00 (Half Union) minted for the Panama-Pacific International Exposition (1915)

- Silvery proof sets minted since 1992 with dimes, quarters and one-half-dollars fabricated of silver rather than the standard copper-nickel

- Presidential dollar coins proof sets minted since 2007

Banknotes [edit]

| Denomination | Front | Reverse | Portrait | Reverse motif | Commencement serial | Latest series | Apportionment |

|---|---|---|---|---|---|---|---|

| One dollar |  |  | George Washington | Great Seal of the United States | Series 1963[d] Series 1935[e] | Series 2017A[51] | Wide |

| Two dollars |  |  | Thomas Jefferson | Declaration of Independence by John Trumbull | Serial 1976 | Series 2017A | Wide |

| Five dollars |  |  | Abraham Lincoln | Lincoln Memorial | Series 2006 | Series 2017A | Broad |

| 10 dollars |  |  | Alexander Hamilton | U.Due south. Treasury | Series 2004A | Series 2017A | Wide |

| 20 dollars |  |  | Andrew Jackson | White Business firm | Series 2004 | Series 2017A | Wide |

| Fifty dollars |  |  | Ulysses S. Grant | United States Capitol | Series 2004 | Series 2017A | Wide |

| One hundred dollars |  |  | Benjamin Franklin | Independence Hall | Series 2009A[52] | Serial 2017A | Wide |

The U.South. Constitution provides that Congress shall accept the ability to "borrow money on the credit of the United States."[53] Congress has exercised that power by authorizing Federal Reserve Banks to event Federal Reserve Notes. Those notes are "obligations of the U.s.a." and "shall be redeemed in lawful money on demand at the Treasury Department of the United States, in the city of Washington, District of Columbia, or at any Federal Reserve depository financial institution".[54] Federal Reserve Notes are designated by law equally "legal tender" for the payment of debts.[55] Congress has also authorized the issuance of more than 10 other types of banknotes, including the United States Note[56] and the Federal Reserve Banking concern Note. The Federal Reserve Note is the simply type that remains in circulation since the 1970s.

Federal Reserve Notes are printed by the Bureau of Engraving and Printing and are made from cotton fiber paper (every bit opposed to wood fiber used to make mutual paper). The "large-sized notes" issued before 1928 measured vii.42 in × iii.125 in (188.5 mm × 79.4 mm), while small-sized notes introduced that year mensurate 6.14 in × two.61 in × 0.0043 in (155.96 mm × 66.29 mm × 0.11 mm).[57] The dimensions of the modern (small-size) U.Southward. currency is identical to the size of Philippine peso banknotes issued under U.s.a. administration afterward 1903, which had proven highly successful.[58] The American large-note bills became known equally "equus caballus blankets" or "saddle blankets."[59]

Currently printed denominations are $ane, $two, $5, $10, $20, $50, and $100. Notes higher up the $100 denomination stopped being printed in 1946 and were officially withdrawn from circulation in 1969. These notes were used primarily in inter-bank transactions or by organized crime; information technology was the latter usage that prompted President Richard Nixon to event an executive order in 1969 halting their use. With the advent of electronic cyberbanking, they became less necessary. Notes in denominations of $500, $one,000, $v,000, $ten,000, and $100,000 were all produced at one time; see big denomination bills in U.Southward. currency for details. With the exception of the $100,000 bill (which was only issued as a Series 1934 Gilt Document and was never publicly circulated; thus it is illegal to ain), these notes are at present collectors' items and are worth more their confront value to collectors.

Though still predominantly green, the post-2004 series incorporate other colors to better distinguish unlike denominations. Every bit a upshot of a 2008 decision in an accessibility lawsuit filed past the American Council of the Blind, the Agency of Engraving and Press is planning to implement a raised tactile characteristic in the next redesign of each note, except the $1 and the current version of the $100 pecker. Information technology besides plans larger, college-contrast numerals, more color differences, and distribution of currency readers to help the visually impaired during the transition period.[60]

Budgetary policy [edit]

The Federal Reserve Human action created the Federal Reserve Organization in 1913 as the cardinal bank of the United States. Its primary task is to conduct the nation'southward monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates in the U.S. economy. It is too tasked to promote the stability of the fiscal system and regulate financial institutions, and to act equally lender of final resort.[61] [62]

The Monetary policy of the United States is conducted by the Federal Open up Market Committee, which is composed of the Federal Reserve Board of Governors and 5 out of the 12 Federal Reserve Depository financial institution presidents, and is implemented by all twelve regional Federal Reserve Banks.

Monetary policy refers to actions made by key banks that decide the size and growth rate of the money supply available in the economy, and which would event in desired objectives like low inflation, low unemployment, and stable fiscal systems. The economy'due south aggregate money supply is the full of

- M0 money, or Monetary Base of operations - "dollars" in currency and bank money balances credited to the central bank's depositors, which are backed by the central bank's avails,

- plus M1, M2, M3 money - "dollars" in the grade of depository financial institution coin balances credited to banks' depositors, which are backed by the bank's assets and investments.

The FOMC influences the level of money available to the economy past the following means:

- Reserve requirements - specifies a required minimum percent of deposits in a commercial banking company that should be held as a reserve (i.east. as deposits with the Federal Reserve), with the rest available to loan or invest. Higher requirements mean less money loaned or invested, helping keep inflation in bank check. Raising the federal funds rate earned on those reserves also helps achieve this objective.

- Open market operations - the Federal Reserve buys or sells US Treasury bonds and other securities held by banks in exchange for reserves; more reserves increase a depository financial institution's capacity to loan or invest elsewhere.

- Discount window lending - banks can borrow from the Federal Reserve.

Monetary policy directly affects involvement rates; it indirectly affects stock prices, wealth, and currency substitution rates. Through these channels, budgetary policy influences spending, investment, product, employment, and aggrandizement in the United states of america. Constructive monetary policy complements fiscal policy to support economic growth.

The adjusted monetary base of operations has increased from approximately $400 billion in 1994, to $800 billion in 2005, and to over $3,000 billion in 2013.[63]

When the Federal Reserve makes a purchase, information technology credits the seller's reserve account (with the Federal Reserve). This coin is not transferred from any existing funds—it is at this point that the Federal Reserve has created new loftier-powered money. Commercial banks then determine how much money to keep in deposit with the Federal Reserve and how much to agree as physical currency. In the latter case, the Federal Reserve places an social club for printed coin from the U.Southward. Treasury Section.[64] The Treasury Department, in turn, sends these requests to the Bureau of Engraving and Printing (to print new dollar bills) and the Bureau of the Mint (to postage the coins).

The Federal Reserve'south monetary policy objectives to keep prices stable and unemployment depression is oft called the dual mandate. This replaces past practices under a gilt standard where the main concern is the gold equivalent of the local currency, or under a gold exchange standard where the concern is fixing the commutation rate versus another gilt-convertible currency (previously good worldwide under the Bretton Wood Agreement of 1944 via stock-still substitution rates to the U.S. dollar).

International use equally reserve currency [edit]

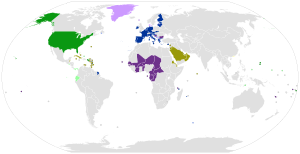

Worldwide utilise of the U.S. dollar:

United States

External adopters of the US dollar

Currencies pegged to the United states dollar

Currencies pegged to the United states of america dollar w/ narrow band

Worldwide use of the euro:

External adopters of the euro

Currencies pegged to the euro

Currencies pegged to the euro w/ narrow band

Clout [edit]

The primary currency used for global merchandise between Europe, Asia, and the Americas has historically been the Spanish-American silver dollar, which created a global silverish standard system from the 16th to 19th centuries, due to abundant silvery supplies in Castilian America.[65] The U.South. dollar itself was derived from this coin. The Spanish dollar was later displaced by the British pound sterling in the advent of the international gold standard in the last quarter of the 19th century.

The U.South. dollar began to displace the pound sterling as international reserve currency from the 1920s since it emerged from the First World War relatively unscathed and since the United States was a significant recipient of wartime gold inflows.[66] After the U.S. emerged as an even stronger global superpower during the Second World War, the Bretton Woods Agreement of 1944 established the post-war international budgetary system, with the U.South. dollar ascending to become the world's primary reserve currency for international trade, and the only post-war currency linked to gold at $35 per troy ounce.[67] Despite all links to aureate existence severed in 1971, the dollar continues to play this function to this day.

As international reserve currency [edit]

The U.Due south. dollar is joined by the world'south other major currencies - the euro, pound sterling, Japanese yen and Chinese renminbi - in the currency basket of the special drawing rights of the International Monetary Fund. Fundamental banks worldwide accept huge reserves of U.S. dollars in their holdings and are pregnant buyers of U.Southward. treasury bills and notes.[68]

Foreign companies, entities, and individual individuals hold U.S. dollars in strange deposit accounts chosen eurodollars (not to be dislocated with the euro), which are outside the jurisdiction of the Federal Reserve System. Private individuals too hold dollars outside the banking arrangement generally in the grade of United states of america$100 bills, of which 80% of its supply is held overseas.

The United states of america Department of the Treasury exercises considerable oversight over the SWIFT fiscal transfers network,[69] and consequently has a huge sway on the global fiscal transactions systems, with the ability to impose sanctions on foreign entities and individuals.[70]

In the global markets [edit]

The U.S. dollar is predominantly the standard currency unit of measurement in which goods are quoted and traded, and with which payments are settled in, in the global commodity markets.[71] The U.S. Dollar Index is an important indicator of the dollar'due south forcefulness or weakness versus a basket of six foreign currencies.

The United states of america Government is capable of borrowing trillions of dollars from the global capital markets in U.Due south. dollars issued past the Federal Reserve, which is itself nether U.South. government purview, at minimal interest rates, and with nigh zippo default run a risk. In dissimilarity, foreign governments and corporations incapable of raising coin in their own local currencies are forced to upshot debt denominated in U.S. dollars, along with its consequent higher interest rates and risks of default.[72] The United States's ability to infringe in its ain currency without facing a significant balance of payments crisis has been frequently described as its exorbitant privilege.[73]

A frequent topic of fence is whether the potent dollar policy of the United States is indeed in America's ain best interests, as well equally in the all-time interest of the international community.[74]

Currencies fixed to the U.S. dollar [edit]

For a more exhaustive word of countries using the U.Southward. dollar as official or customary currency, or using currencies which are pegged to the U.S. dollar, see International use of the U.South. dollar#Dollarization and stock-still exchange rates and Currency substitution#US dollar.

Countries using the U.S. dollar as its official currency include:

- In the Americas: Panama, Ecuador, El Salvador, British Virgin Islands, Turks and Caicos Islands, and the Caribbean Netherlands.

- The constituent states of the onetime Trust Territory of the Pacific Islands: Palau, the Federated States of Federated states of micronesia, and the Republic of the marshall islands.

- Others: East timor.

Among the countries using the U.S. dollar together with other strange currencies and its local currency are Cambodia and Zimbabwe.

Currencies pegged to the U.South. dollar include:

- In the Caribbean area: the Bahamian dollar, Barbadian dollar, Belize dollar, Bermudan dollar, Cayman Islands dollar, East Caribbean area dollar, Netherlands Antillean guilder and the Aruban florin.

- The currencies of the oil-producing Arab countries: the Saudi riyal, United Arab Emirates dirham, Omani rial, Qatari riyal and the Bahraini dinar.

- Others: the Hong Kong dollar, Macanese pataca, Lebanese Pound .

Value [edit]

|

|

|

U.Due south. Consumer Price Alphabetize, starting from 1913

The sixth paragraph of Section viii of Article 1 of the U.Southward. Constitution provides that the U.S. Congress shall have the power to "coin money" and to "regulate the value" of domestic and strange coins. Congress exercised those powers when it enacted the Coinage Act of 1792. That Act provided for the minting of the first U.S. dollar and it declared that the U.Due south. dollar shall take "the value of a Castilian milled dollar as the same is now current".[75]

The tabular array in a higher place shows the equivalent corporeality of goods that, in a particular year, could be purchased with $1. The table shows that from 1774 through 2012 the U.S. dollar has lost about 97.0% of its buying power.[76]

The decline in the value of the U.Southward. dollar corresponds to price aggrandizement, which is a rise in the general level of prices of goods and services in an economy over a period of fourth dimension.[77] A consumer price index (CPI) is a mensurate estimating the average price of consumer goods and services purchased by households. The United States Consumer Price Index, published by the Bureau of Labor Statistics, is a measure out estimating the average price of consumer goods and services in the U.s.a..[78] It reflects aggrandizement as experienced by consumers in their day-to-day living expenses.[79] A graph showing the U.S. CPI relative to 1982–1984 and the annual year-over-year alter in CPI is shown at right.

The value of the U.S. dollar declined significantly during wartime, especially during the American Civil War, World War I, and World War II.[80] The Federal Reserve, which was established in 1913, was designed to replenish an "elastic" currency subject to "substantial changes of quantity over brusk periods", which differed significantly from previous forms of high-powered money such as aureate, national banknotes, and silver coins.[81] Over the very long run, the prior gold standard kept prices stable—for case, the price level and the value of the U.S. dollar in 1914 were non very dissimilar from the price level in the 1880s. The Federal Reserve initially succeeded in maintaining the value of the U.S. dollar and price stability, reversing the aggrandizement caused by the Start World War and stabilizing the value of the dollar during the 1920s, before presiding over a 30% deflation in U.Southward. prices in the 1930s.[82]

Under the Bretton Forest system established after Earth War II, the value of gold was fixed to $35 per ounce, and the value of the U.South. dollar was thus anchored to the value of gold. Rising authorities spending in the 1960s, however, led to doubts virtually the ability of the United states of america to maintain this convertibility, aureate stocks dwindled as banks and international investors began to convert dollars to gold, and every bit a result, the value of the dollar began to decline. Facing an emerging currency crunch and the imminent danger that the United States would no longer be able to redeem dollars for gold, gilded convertibility was finally terminated in 1971 past President Nixon, resulting in the "Nixon shock".[83]

The value of the U.S. dollar was therefore no longer anchored to gold, and it fell upon the Federal Reserve to maintain the value of the U.Southward. currency. The Federal Reserve, however, continued to increase the money supply, resulting in stagflation and a chop-chop declining value of the U.Due south. dollar in the 1970s. This was largely due to the prevailing economic view at the time that inflation and existent economic growth were linked (the Phillips bend), and so inflation was regarded as relatively benign.[83] Betwixt 1965 and 1981, the U.S. dollar lost two thirds of its value.[76]

In 1979, President Carter appointed Paul Volcker Chairman of the Federal Reserve. The Federal Reserve tightened the money supply and aggrandizement was substantially lower in the 1980s, and hence the value of the U.S. dollar stabilized.[83]

Over the thirty-year menstruation from 1981 to 2009, the U.S. dollar lost over half its value.[76] This is because the Federal Reserve has targeted not zero inflation, but a low, stable rate of aggrandizement—between 1987 and 1997, the rate of aggrandizement was approximately three.5%, and betwixt 1997 and 2007 it was approximately two%. The so-chosen "Swell Moderation" of economic conditions since the 1970s is credited to monetary policy targeting price stability.[84]

There is an ongoing debate well-nigh whether central banks should target zero inflation (which would mean a constant value for the U.Southward. dollar over time) or low, stable inflation (which would mean a continuously but slowly failing value of the dollar over time, every bit is the example now). Although some economists are in favor of a zero inflation policy and therefore a constant value for the U.Southward. dollar,[82] others debate that such a policy limits the ability of the key banking company to control interest rates and stimulate the economy when needed.[85]

Exchange rates [edit]

Historical exchange rates [edit]

| Currency units | 1970[i] | 1980[i] | 1985[i] | 1990[i] | 1993 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2018[89] |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Euro | — | — | — | — | — | 0.9387 | 1.0832 | i.1171 | 1.0578 | 0.8833 | 0.8040 | 0.8033 | 0.7960 | 0.7293 | 0.6791 | 0.7176 | 0.6739 | 0.7178 | 0.7777 | 0.7530 | 0.7520 | 0.9015 | 0.8504 |

| Japanese yen | 357.half-dozen | 240.45 | 250.35 | 146.25 | 111.08 | 113.73 | 107.80 | 121.57 | 125.22 | 115.94 | 108.15 | 110.11 | 116.31 | 117.76 | 103.39 | 93.68 | 87.78 | 79.70 | 79.82 | 97.sixty | 105.74 | 121.05 | 111.130 |

| Pound sterling | 8s 4d =0.4167 | 0.4484[ii] | 0.8613[ii] | 0.6207 | 0.6660 | 0.6184 | 0.6598 | 0.6946 | 0.6656 | 0.6117 | 0.5456 | 0.5493 | 0.5425 | 0.4995 | 0.5392 | 0.6385 | 0.4548 | 0.6233 | 0.6308 | 0.6393 | 0.6066 | 0.6544 | 0.7454 |

| Swiss franc | 4.12 | i.68 | 2.46[90] | 1.39 | 1.48 | i.l | 1.69 | i.69 | i.62 | 1.forty | 1.24 | ane.15 | i.29 | 1.23 | 1.12 | one.08 | 1.03 | 0.93 | 0.93 | 0.90 | 0.92 | 1.00 | 0.98 |

| Canadian dollar[91] | i.081 | 1.168 | one.321 | 1.1605 | one.2902 | 1.4858 | 1.4855 | ane.5487 | ane.5704 | ane.4008 | ane.3017 | 1.2115 | 1.1340 | 1.0734 | 1.0660 | 1.1412 | 1.0298 | 0.9887 | 0.9995 | one.0300 | 1.1043 | 1.2789 | ane.2842 |

| Mexican peso[92] | 0.01250–0.02650[iii] | two.80[three] | 2.67[iii] | two.l[iii] | 3.1237 | 9.553 | ix.459 | 9.337 | 9.663 | x.793 | 11.290 | 10.894 | 10.906 | 10.928 | 11.143 | thirteen.498 | 12.623 | 12.427 | 13.154 | 12.758 | thirteen.302 | 15.837 | nineteen.911 |

| Chinese Renminbi[93] | 2.46 | 1.7050 | 2.9366 | 4.7832 | 5.7620 | 8.2783 | 8.2784 | viii.2770 | 8.2771 | 8.2772 | 8.2768 | eight.1936 | 7.9723 | seven.6058 | 6.9477 | 6.8307 | 6.7696 | 6.4630 | 6.3093 | half dozen.1478 | 6.1620 | 6.2840 | vi.383 |

| Pakistani rupee | 4.761 | 9.9 | xv.9284 | 21.707 | 28.107 | 51.9 | 51.9 | 63.5 | threescore.5 | 57.75 | 57.viii | 59.7 | 60.4 | 60.83 | 67 | lxxx.45 | 85.75 | 88.6 | xc.seven | 105.477 | 100.661 | 104.763 | 139.850 |

| Indian rupee | seven.56 | eight.000 | 12.38 | 16.96 | 31.291 | 43.xiii | 45.00 | 47.22 | 48.63 | 46.59 | 45.26 | 44.00 | 45.19 | 41.18 | 43.39 | 48.33 | 45.65 | 46.58 | 53.37 | 58.51 | 62.00 | 64.1332 | 68.xi |

| Singapore dollar | — | — | 2.179 | 1.903 | ane.6158 | 1.6951 | ane.7361 | 1.7930 | 1.7908 | 1.7429 | one.6902 | 1.6639 | 1.5882 | 1.5065 | 1.4140 | 1.4543 | 1.24586 | 1.2565 | 1.2492 | one.2511 | i.2665 | ane.3748 | i.343 |

Current exchange rates [edit]

| Current USD commutation rates | |

|---|---|

| From Google Finance: | AUD CAD CHF CNY EUR GBP HKD JPY MXN TWD KRW |

| From Yahoo! Finance: | AUD CAD CHF CNY EUR GBP HKD JPY MXN TWD KRW |

| From XE.com: | AUD CAD CHF CNY EUR GBP HKD JPY MXN TWD KRW |

| From OANDA: | AUD CAD CHF CNY EUR GBP HKD JPY MXN TWD KRW |

Run into besides [edit]

- Counterfeit The states currency

- Dedollarisation

- International use of the U.S. dollar

- List of the largest trading partners of the United States

- Monetary policy of the The states

- Petrodollar recycling

- Strong dollar policy

- U.S. Dollar Alphabetize

Notes [edit]

- ^ Alongside E Timor centavo coins

- ^ Alongside Ecuadorian centavo coins

- ^ Alongside Bitcoin

- ^ Obverse

- ^ Contrary

- ^ a b c d Mexican peso values prior to 1993 revaluation

- ^ a b 1970–1992. 1980 derived from AUD–USD=i.1055 and AUD–GBP=0.4957 at end of Dec 1979: 0.4957/ane.1055=0.448394392; 1985 derived from AUD–USD=0.8278 and AUD–GBP=0.7130 at end of Dec 1984: 0.7130/0.8278=0.861319159.

- ^ a b c d Value at the showtime of the year

References [edit]

- ^ "Coinage Deed of 1792" (PDF). United States Congress. Archived from the original (PDF) on April vii, 2004. Retrieved Apr ii, 2008.

- ^ Nay Im, Tal; Dabadie, Michel (March 31, 2007). "Dollarization in Cambodia" (PDF). National Bank of Cambodia . Retrieved Apr 11, 2022.

- ^ Nagumo, Jada (August 4, 2021). "Cambodia aims to wean off United states of america dollar dependence with digital currency". Nikkei Asia. Retrieved April xi, 2022.

Kingdom of cambodia runs a dual-currency system, with the U.S. dollar widely circulating in its economy. The country's dollarization began in the 1980s and 90s, following years of civil war and unrest.

- ^ "Central Bank of Timor-Leste". Retrieved March 22, 2017.

The official currency of Timor-Leste is the The states dollar, which is legal tender for all payments made in cash.

- ^ "Ecuador". CIA World Factbook. October 18, 2010. Retrieved Oct 17, 2018.

The dollar is legal tender

- ^ "Republic of el salvador". CIA Globe Factbook. Oct 21, 2010. Retrieved Oct 17, 2018.

The US dollar became El salvador'due south currency in 2001

- ^ "Nixon Ends Convertibility of Us Dollars to Gold and Announces Wage/Price Controls". Federal Reserve Banking concern of Richmond. Retrieved October 17, 2018.

- ^ "The Implementation of Monetary Policy – The Federal Reserve in the International Sphere" (PDF) . Retrieved October 17, 2018.

- ^ Cohen, Benjamin J. 2006. The Time to come of Money, Princeton University Press. ISBN 0-691-11666-0.

- ^ Agar, Charles. 2006. Vietnam, (Frommer'due south). ISBN 0-471-79816-9. p. 17: "the dollar is the de facto currency in Kingdom of cambodia."

- ^ "How much U.S. currency is in apportionment?". Federal Reserve. Retrieved Feb 27, 2021.

- ^ U.S. Constitution, Article one, Section viii. para. five.

- ^ a b c Denominations, specifications, and blueprint of coins. 31 U.S.C. § 5112.

- ^ U.S. Constitution, Commodity 1, Section ix. para. 7.

- ^ Reports. 31 U.S.C. § 331.

- ^ "Financial Report of the United States Government" (PDF). Department of the Treasury. 2009. Archived from the original (PDF) on November thirteen, 2018. Retrieved October 17, 2018.

- ^ a b U.South. Congress. 1792. Coinage Human activity of 1792. 2nd Congress, 1st Session. Sec. nine, ch. 16. Retrieved 6 June 2020.

- ^ a b Fitzpatrick, John C., ed. (1934). "Tuesday, August 8, 1786". Journals of the Continental Congress 1774-1789. XXXI: 1786: 503–505. Retrieved December 5, 2019.

- ^ Peters, Richard, ed. (1845). "Second Congress. Sess. I. Ch. 16". The Public Statues at Big of the United States of America, Etc. Etc. i: 246–251. Retrieved December 5, 2019.

- ^ Langland, Connie (May 27, 2015). "What is a millage rate and how does it affect school funding?". WHYY. PBS and NPR. Retrieved December 5, 2019.

- ^ a b "Mills Currency". Past & Present. Stamp and Money Identify Blog. September 26, 2018. Archived from the original on May three, 2021. Retrieved December 5, 2019.

- ^ a b "How much is "two $.25" and where did the phrase".

- ^ "Decimal Trading Definition and History".

- ^ Mehl, B. Max. "United States $50.00 Gold Pieces, 1877", in Star Rare Coins Encyclopedia and Premium Catalogue (20th edition, 1921)

- ^ a b "Ask US." National Geographic. June 2002. p. ane.

- ^ There'southward no solid reference on the desirability of liondollars in N America and on one:1 parity with heavier dollars. A dollar worth $0.80 Spanish is not cheap if priced at $0.fifty http://coins.lakdiva.org/netherlands/1644_wes_lion_daalder_ag.html https://coins.nd.edu/ColCoin/ColCoinIntros/King of beasts-Dollar.intro.html

- ^ "Buck". Online Etymology Dictionary . Retrieved October 17, 2018.

- ^ "Paper Money Glossary". Littleton Coin Company. Retrieved October 17, 2018.

- ^ Scutt, David (June iii, 2019). "The Australian dollar is grinding higher as expectations for rate cuts from the US Federal Reserve build". Business Insider . Retrieved August 7, 2019.

- ^ Tappe, Anneken (August 9, 2018). "New Zealand dollar leads G-10 losers as greenback gains strengt". MarketWatch . Retrieved Baronial 7, 2019.

- ^ "UPDATE 1-S Africa's rand firms confronting greenback, stocks rise". Reuters . Retrieved Baronial vii, 2019. [ expressionless link ]

- ^ "Why rupee is in one case again under pressure". Business Today. April 22, 2019. Retrieved August vii, 2019.

- ^ Cajori, Florian ([1929]1993). A History of Mathematical Notations (Vol. 2). New York: Dover, 15–29. ISBN 0-486-67766-4

- ^ Aiton, Arthur S.; Wheeler, Benjamin W. (1931). "The Kickoff American Mint". The Hispanic American Historical Review. xi (2). p. 198 and note 2 on p. 198. doi:ten.1215/00182168-11.two.198. JSTOR 2506275.

- ^ Nussbaum, Arthur (1957). A History of the Dollar . New York: Columbia University Printing. p. 56.

The dollar sign, $, is connected with the peso, contrary to popular conventionalities, which considers information technology to be an abbreviation of 'U.S.' The two parallel lines represented one of the many abbreviations of 'P,' and the 'S' indicated the plural. The abridgement '$.' was too used for the peso, and is even so used in Argentina.

- ^ "U.S. Agency of Engraving and Printing - FAQs". www.bep.gov.

- ^ Rand, Ayn. [1957] 1992. Atlas Shrugged. Signet. p. 628.

- ^ James, James Alton (1970) [1937]. Oliver Pollock: The Life and Times of an Unknown Patriot. Freeport: Books for Libraries Press. p. 356. ISBN978-0-8369-5527-9.

- ^ Mint, U.S. "Coinage Act of 1792". U.S. treasury.

- ^ See [ane].

- ^ Sumner, West. G. (1898). "The Spanish Dollar and the Colonial Shilling". The American Historical Review. three (iv): 607–619. doi:10.2307/1834139. JSTOR 1834139.

- ^ "U.s. Dollar". OANDA. Retrieved Oct 17, 2018.

- ^ "Engraving and printing currency and security documents:Article b". Legal Information Institute. Retrieved December 19, 2013.

- ^ Matt Soniak (July 22, 2011). "On the Money: Everything You lot Ever Wanted to Know About Coin Portraits". Mental Floss . Retrieved October 17, 2018.

- ^ Newman, Eric P. (1990). The Early Newspaper Coin of America (iii ed.). Iola, Wisconsin: Krause Publications. p. 17. ISBN0-87341-120-Ten.

- ^ Wright, Robert E. (2008). One Nation Under Debt: Hamilton, Jefferson, and the History of What We Owe. New York, New York: McGraw-Hill. pp. fifty–52. ISBN978-0-07-154393-four.

- ^ Silver bullion tin can be converted in unlimited quantities of Trade dollars of 420 grains, but these were meant for export and had legal tender limits in the US. See Trade dollar (United states coin).

- ^ Anderson, Gordon T. 25 April 2005. "Congress tries once more for a dollar coin." CNN Money.

- ^ Christian Zappone (July xviii, 2006). "Kill-the-penny bill introduced". CNN Money . Retrieved October 17, 2018.

- ^ Weinberg, Ali (February 19, 2013). "Penny pinching: Tin Obama manage elimination of ane-cent money?". NBC News. Retrieved Oct 17, 2018.

- ^ "USPaperMoney.Info: Series 2017A $ane". www.uspapermoney.info.

- ^ "$100 Note | U.S. Currency Education Program".

- ^ "Paragraph two of Section 8 of Article 1 of the United States Constitution". Topics.law.cornell.edu. Retrieved October 17, 2018.

- ^ "Section 411 of Championship 12 of the The states Code". Constabulary.cornell.edu. June 22, 2010. Retrieved October 17, 2018.

- ^ "Section 5103 of Championship 31 of the Usa Code". Law.cornell.edu. August 6, 2010. Retrieved Oct 17, 2018.

- ^ "Section 5115 of Title 31 of the The states Code". Law.cornell.edu. Baronial 6, 2010. Retrieved October 17, 2018.

- ^ "Treasury Department Appropriation Bill for 1929: Hearing Before the Subcommittee of Business firm Committee on Appropriations... Seventieth Congress, First Session". 1928.

- ^ Schwarz, John; Lindquist, Scott (September 21, 2009). Standard Guide to Minor-Size U.South. Newspaper Money - 1928-Date. ISBN9781440225789.

- ^ Orzano, Michele. "What is a horse blanket note?". Coin World. Coin World. Retrieved November 29, 2021.

- ^ See Federal Reserve Note for details and references

- ^ "Federal Reserve Lath - Purposes & Functions".

- ^ "Conducting Budgetary Policy" (PDF). United States Federal Reserve. Retrieved August 23, 2021.

{{cite web}}: CS1 maint: url-status (link) - ^ "St. Louis Adjusted Monetary Base". Federal Reserve Bank of St. Louis. February 15, 1984. Retrieved October 17, 2018.

- ^ "Fact Sheets: Currency & Coins". United states Section of the Treasury. Retrieved October 17, 2018.

- ^ "'The Silver Mode' Explains How the Erstwhile Mexican Dollar Changed the Globe". April 30, 2017.

- ^ Eichengreen, Barry; Flandreau, Marc (2009). "The ascension and fall of the dollar (or when did the dollar supersede sterling every bit the leading reserve currency?)". European Review of Economic History. thirteen (3): 377–411. doi:ten.1017/S1361491609990153. ISSN 1474-0044. S2CID 154773110.

- ^ "How a 1944 Agreement Created a New Earth Order".

- ^ "Major foreign holders of U.S. Treasury securities 2021".

- ^ "SWIFT oversight".

- ^ "Sanctions Programs and Country Information | U.S. Department of the Treasury".

- ^ "Affect of the Dollar on Article Prices".

- ^ "Dollar Bail".

- ^ "The dollar'south international role: An "exorbitant privilege"?". November 30, 2001.

- ^ Mohsin, Saleha (Jan 21, 2021). "The Strong Dollar". Bloomberg . Retrieved August 23, 2021.

{{cite news}}: CS1 maint: url-status (link) - ^ "Section ix of the Coinage Act of 1792". Memory.loc.gov. Retrieved August 24, 2010.

- ^ a b c "Measuring Worth – Purchasing Ability of Money in the United States from 1774 to 2010". Retrieved April 22, 2010.

- ^ Olivier Blanchard (2000). Macroeconomics (2nd ed.), Englewood Cliffs, N.J: Prentice Hall, ISBN 0-thirteen-013306-X

- ^ "Consumer Price Alphabetize Frequently Asked Questions". Retrieved October sixteen, 2018.

- ^ "Consumer Price Alphabetize Frequently Asked Questions". Retrieved October 17, 2018.

- ^ Milton Friedman, Anna Jacobson Schwartz (November 21, 1971). A budgetary history of the United states of america, 1867–1960. p. 546. ISBN978-0691003542.

- ^ Friedman 189–190

- ^ a b "Central Cyberbanking—And then and Now". Retrieved Oct 17, 2018.

- ^ a b c "Controlling Aggrandizement: A Historical Perspective" (PDF). Archived from the original (PDF) on December 7, 2010. Retrieved July 17, 2010.

- ^ "Monetary Credibility, Aggrandizement, and Economic Growth". Retrieved July 17, 2010.

- ^ "U.S. Monetary Policy: The Fed'southward Goals". Retrieved Oct 17, 2018.

- ^ U.Due south. Federal Reserve: Final iv years, 2009–2012, 2005–2008, 2001–2004, 1997–2000, 1993–1996; Reserve Depository financial institution of Australia: 1970–present

- ^ 2004–present

- ^ "FRB: Foreign Exchange Rates – Grand.5A; Release Dates". Lath of Governors of the Federal Reserve Organization. Retrieved July 23, 2014.

- ^ "Historical Exchange Rates Currency Converter". TransferMate.com.

- ^ "Exchange Rates Betwixt the U.s.a. Dollar and the Swiss Franc." Measuring Worth. Retrieved October 17, 2018.

- ^ 1977–1991

- ^ 1976–1991

- ^ 1974–1991, 1993–1995

Farther reading [edit]

- Prasad, Eswar Due south. (2014). The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global Finance. Princeton, NJ: Princeton University Printing. ISBN978-0-691-16112-ix.

External links [edit]

- U.S. Agency of Engraving and Printing Archived May xxx, 1997, at the Wayback Machine

- U.S. Currency and Coin Outstanding and in Apportionment

- American Currency Showroom at the San Francisco Federal Reserve Bank

- Relative values of the U.S. dollar, from 1774 to present

- Historical Currency Converter

- Summary of BEP Production Statistics

Images of U.S. currency and coins [edit]

- U.S. Currency Didactics Program page with images of all current banknotes

- U.Southward. Mint: Epitome Library

- Historical and current banknotes of the United States (in English and German)

Source: https://en.wikipedia.org/wiki/United_States_dollar

Posted by: cooperournisid.blogspot.com

0 Response to "How Much Is All Money In United State"

Post a Comment