Where Is American Money With The Most?

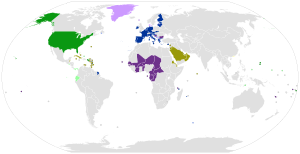

Worldwide use of the U.South. dollar:

United States

External adopters of the U.s. dollar

Currencies pegged to the US dollar

Currencies pegged to the United states of america dollar w/ narrow ring

Worldwide use of the euro:

External adopters of the euro

Currencies pegged to the euro

Currencies pegged to the euro w/ narrow band

Note that the Belorussian ruble is pegged to the euro, Russian ruble, and U.S. dollar in a currency basket.

The U.s. dollar was established as the world's foremost reserve currency by the Bretton Woods Agreement of 1944. It claimed this status from the British pound sterling after the destruction of two globe wars and the massive spending of Smashing Britain's golden reserves. Despite all links to gold existence severed in 1971, the dollar continues to be the earth'south foremost reserve currency. Furthermore, the Bretton Woods Understanding also ready the global mail service-war budgetary system past setting up rules, institutions and procedures for conducting international trade and accessing the global capital markets using the U.S. dollar.

The U.Southward. dollar is widely held by central banks, foreign companies and private individuals worldwide, in the grade of eurodollar foreign deposit accounts (non to be confused with the euro), besides as in the course of US$100 bills, an estimated 75% of which are held overseas.[1] The U.Due south. dollar is predominantly the standard currency unit in which goods are quoted and traded, and with which payments are settled in, in the global article markets.[2]

The U.S. dollar is also the official currency in several countries and the de facto currency in many others, with Federal Reserve Notes (and, in a few cases, U.S. coins) used in apportionment.

The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation'due south central bank.

Clout [edit]

The principal currency used for trade around the world, between Europe, Asia and the Americas had historically been the Spanish-American silver dollar, which created a global silver standard system from the 16th to 19th centuries, due to abundant silver supplies in Spanish America.[3] The U.Southward. dollar itself was derived from this coin. The Spanish dollar was later on displaced by the British pound sterling in the advent of the international golden standard in the terminal quarter of the 19th century.

The U.S. dollar began to displace the pound sterling equally international reserve currency from the 1920s since information technology emerged from the First World State of war relatively unscathed and since the United States was a significant recipient of wartime golden inflows. [4] Later the U.South. emerged every bit an even stronger global superpower during the 2nd World War, the Bretton Woods Understanding of 1944 established the postal service-war international budgetary system, with the U.S. dollar ascending to go the world's primary reserve currency for international trade, and the just post-state of war currency linked to gold at $35 per troy ounce. [5] Despite all links to aureate being severed in 1971, the dollar continues to play this role to this day.

International reserve currency [edit]

The U.S. dollar is joined by the world's other major currencies - the euro, pound sterling, Japanese yen and Chinese renminbi - in the currency basket of the Special drawing rights of the International Budgetary Fund. Cardinal banks worldwide have huge reserves of U.S. dollars in their holdings, and are pregnant buyers of U.S. treasury bills and notes.[6]

Foreign companies, entities and private individuals hold U.Due south. dollars in foreign eolith accounts called eurodollars (non to be confused with the euro), which are exterior the jurisdiction of the Federal Reserve Organisation. Private individuals as well concur dollars outside the cyberbanking system mostly in the form of U.s.$100 bills, of which 75% of its supply are held overseas.

The The states Section of the Treasury exercises considerable oversight over the SWIFT financial transfers network,[7] and consequently has a huge sway on the global fiscal transactions systems, with the ability to impose sanctions on foreign entities and individuals.[8]

Economist Paul Samuelson and others (including, at his death, Milton Friedman) take maintained that the overseas demand for dollars allows the United states to maintain persistent merchandise deficits without causing the value of the currency to depreciate or the flow of trade to readjust. Just Samuelson stated in 2005 that at some uncertain futurity period these pressures would precipitate a run confronting the U.Due south. dollar with serious global financial consequences.[9]

In August 2007, ii scholars affiliated with the government of the People's Republic of China threatened to sell its substantial reserves in American dollars in response to American legislative discussion of merchandise sanctions designed to revalue the Chinese yuan.[10] The Chinese authorities denied that selling dollar-denominated assets would be an official policy in the foreseeable futurity. India and Russia has also announced moves to diversify reserves abroad from the U.S. dollar.[eleven]

After the euro's share of global official strange exchange reserves approached 25% as of year-end 2006 (vs 65% for the U.Southward. dollar; see table in Reserve currency#Global currency reserves), former Federal Reserve Chairman Alan Greenspan said in September 2007 that it is "admittedly conceivable that the euro will replace the dollar every bit reserve currency, or volition be traded as an equally important reserve currency."[12] As of 2021, still, none of this has come to fruition due to the European debt crisis which engulfed the PIIGS countries from 2009-2014. Instead the euro'southward stability and future existence was put into doubt, which reduced its share of global reserves to 19% equally of year-cease 2015 (vs 66% for USD). As of year-end 2020 these figures stand at 21% for EUR and 59% for USD.

The percental composition of currencies of official strange exchange reserves from 1995 to 2020.[13] [14] [xv]

In the global markets [edit]

The U.South. dollar is predominantly the standard currency unit in which goods are quoted and traded, and with which payments are settled in, in the global commodity markets.[two] Encounter petrocurrency, petrodollar.

The United states of america Government is capable of borrowing trillions of dollars from the global capital markets in U.Due south. dollars issued by the Federal Reserve, which is itself under US government purview, at minimal interest rates and with virtually zero default risk. In dissimilarity, foreign governments and corporations incapable of raising coin in their ain local currencies are forced to upshot debt denominated in U.Due south. dollars, along with its consequent higher interest rates and risks of default.[sixteen] The United States's ability to infringe in its ain currency without facing significant balance of payments crisis has been frequently described as its exorbitant privilege.[17]

U.S. Dollar Alphabetize [edit]

The U.S. Dollar Alphabetize (Ticker: USDX) is the creation of the New York Lath of Trade (NYBOT), renamed in September 2007 to Water ice Futures Us. It was established in 1973 for tracking the value of the USD against a basket of currencies, which, at that fourth dimension, represented the largest trading partners of the U.s.. It began with 17 currencies from 17 nations, merely the launch of the euro subsumed 12 of these into 1, so the USDX tracks only six currencies today.

| Euro | 57.6% |

| Japanese yen | 13.6% |

| Pound sterling | xi.nine% |

| Canadian dollar | 9.one% |

| Swedish krona | iv.2% |

| Swiss franc | 3.6% |

| Source: Water ice[18] | |

The Index is described by the ICE every bit "a geometrically-averaged calculation of six currencies weighted against the U.S. dollar."[18] The baseline of 100.00 on the USDX was fix at its launch in March 1973. This event marks the watershed between the wider margins arrangement of the Smithsonian regime and the period of generalized floating that led upwardly to the Second Subpoena of the Articles of Understanding of the International Budgetary Fund. Since 1973, the USDX has climbed as high as the 160s and drifted every bit low as the 70s.

The USDX has not been updated to reflect new trading realities in the global economic system, where the bulk of trade has shifted strongly towards new partners like Red china and Mexico and oil-exporting countries while the Us has de-industrialized.

Dollarization and fixed exchange rates [edit]

Other nations too the United States use the U.S. dollar as their official currency, a process known equally official dollarization. For example, Panama has been using the dollar alongside the Panamanian balboa as the legal tender since 1904 at a conversion rate of one:1. Ecuador (2000), El salvador (2001), and East timor (2000) all adopted the currency independently. The one-time members of the U.S.-administered Trust Territory of the Pacific Islands, which included Palau, the Federated states of micronesia, and the Republic of the marshall islands, chose non to issue their own currency after becoming independent, having all used the U.S. dollar since 1944. Two British dependencies also use the U.S. dollar: the British Virgin Islands (1959) and Turks and Caicos Islands (1973). The islands Bonaire, Sint Eustatius and Saba, at present collectively known as the Caribbean Netherlands, adopted the dollar on January ane, 2011, as a result of the dissolution of the Netherlands Antilles.[xix] [xx]

The U.S. dollar is an official currency in Zimbabwe, along with the Euro, the Pound Sterling, the Pula, the Rand, and several other currencies. A series of Zimbabwean Bond Coins was put into circulation on 18 December 2014 in 1, 5, 10, and 25 cent denominations, and after 50 cent and 1 dollar bonds coins, which are pegged at the same rate every bit American coins.

Some countries that have adopted the U.S. dollar issue their own coins: See Ecuadorian centavo coins, Panamanian Balboa and East timor centavo coins.

Some other countries link their currency to U.Southward. dollar at a fixed commutation charge per unit. The local currencies of Bermuda and the Bahamas can exist freely exchanged at a 1:ane ratio for USD. Argentina used a fixed 1:ane substitution rate between the Argentine peso and the U.S. dollar from 1991 until 2002. The currencies of Barbados and Belize are similarly convertible at an approximate 2:1 ratio. The Netherlands Antillean guilder (and its successor the Caribbean area guilder) and the Aruban florin are pegged to the dollar at a fixed rate of 1:ane.79. The East Caribbean dollar is pegged to the dollar at a fixed rate of 2.7:1, and is used past all of the countries and territories of the OECS other than the British Virgin Islands. In Lebanon, one dollar is equal to 1500 Lebanese pound, and is used interchangeably with local currency as de facto legal tender. The exchange rate between the Hong Kong dollar and the Us dollar has also been linked since 1983 at HK$7.8/USD, and pataca of Macau, pegged to Hong Kong dollar at MOP1.03/HKD, indirectly linked to the U.S. dollar at roughly MOP8/USD. Several oil-producing Arab countries on the Farsi Gulf, including Saudi arabia, peg their currencies to the dollar, since the dollar is the currency used in the international oil trade.

The Cathay's renminbi was informally and controversially pegged to the dollar in the mid-1990s at ¥ 8.28/USD. Likewise, Malaysia pegged its ringgit at RM3.8/USD in September 1998, after the fiscal crunch. On July 21, 2005, both countries removed their pegs and adopted managed floats confronting a basket of currencies. Kuwait did likewise on May 20, 2007.[21] However, later on three years of slow appreciation, the Chinese yuan has been de facto re-pegged to the dollar since July 2008 at a value of ¥6.83/USD; although no official declaration had been made, the yuan has remained effectually that value within a narrow band since then, similar to the Hong Kong dollar.

Several countries employ a crawling peg model, wherein currency is devalued at a stock-still rate relative to the dollar. For example, the Nicaraguan córdoba is devalued past 5% per annum.[22]

Belarus, on the other manus, pegged its currency, the Belarusian ruble, to a basket of strange currencies (U.South. dollar, euro and Russian ruble) in 2009.[23] In 2011 this led to a currency crunch when the government became unable to honor its promise to convert Belarusian rubles to foreign currencies at a stock-still exchange rate. BYR commutation rates dropped by two thirds, all import prices rose and living standards roughshod.[24]

In some countries, such as Republic of costa rica and Honduras, the U.S. dollar is commonly accepted, although not officially regarded every bit legal tender. In United mexican states's northern border expanse and major tourist zones, information technology is accepted equally if information technology were a second legal currency. Many Canadian merchants close to the edge, equally well as large stores in big cities and major tourist hotspots in Republic of peru also accept U.S. dollars, though usually at a value that favours the merchant. In Cambodia, U.S. notes circulate freely and are preferred over the Cambodian riel for large purchases,[25] [26] with the riel used for change to suspension ane USD. Later the U.S. invasion of Transitional islamic state of afghanistan, U.S. dollars were accepted as if legal tender, simply in 2021 the Taliban authorities banned the use of foreign currencies.[27]

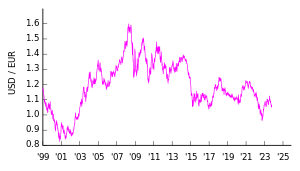

Dollar versus Euro [edit]

Euro-US Dollar commutation rate, from 1999

| Year | Highest ↑ | Everyman ↓ | ||||

|---|---|---|---|---|---|---|

| Date | Rate | Date | Rate | |||

| 1999 | 03 Dec | €0.9985 | 05 Jan | €0.8482 | ||

| 2000 | 26 Oct | €i.2118 | 06 Jan | €0.9626 | ||

| 2001 | 06 Jul | €one.1927 | 05 Jan | €1.0477 | ||

| 2002 | 28 Jan | €1.1658 | 31 Dec | €0.9536 | ||

| 2003 | 08 Jan | €0.9637 | 31 Dec | €0.7918 | ||

| 2004 | 14 May | €0.8473 | 28 Dec | €0.7335 | ||

| 2005 | fifteen Nov | €0.8571 | 03 Jan | €0.7404 | ||

| 2006 | 02 January | €0.8456 | 05 December | €0.7501 | ||

| 2007 | 12 January | €0.7756 | 27 Nov | €0.6723 | ||

| 2008 | 27 October | €0.8026 | 15 Jul | €0.6254 | ||

| 2009 | 04 Mar | €0.7965 | 03 Dec | €0.6614 | ||

| 2010 | 08 Jun | €0.8374 | 13 January | €0.6867 | ||

| 2011 | ten Jan | €0.7750 | 29 Apr | €0.6737 | ||

| 2012 | 24 Jul | €0.8272 | 28 Feb | €0.7433 | ||

| 2013 | 27 Mar | €0.7832 | 27 Dec | €0.7239 | ||

| 2014 | 31 Dec | €0.8237 | eight May | €0.7167 | ||

| 2015 | 13 Apr | €0.9477 | 2 January | €0.8304 | ||

| Source: Euro exchange rates in USD, ECB | ||||||

Not long after the introduction of the euro (€; ISO 4217 code EUR) as a cash currency in 2002, the dollar began to depreciate steadily in value, every bit it did against other major currencies. From 2003 to 2005, this depreciation continued, reflecting a widening current business relationship deficit. Although the current business relationship deficit began to stabilize in 2006 and 2007, depreciation persisted. The fallout from the subprime mortgage crisis in 2008 prompted the Federal Reserve to lower interest rates in September 2007,[28] and again in March 2008,[29] sending the euro to a record high of $1.6038, reached in July 2008. [30] In addition to the trade arrears, the U.Southward. dollar's decline was linked to a multifariousness of other factors, including a major fasten in oil prices.[31]

Nonetheless, a sharp turnaround began in belatedly 2008 with the onset of the global financial crisis. As investors sought out safe-haven investments in U.South. treasuries and Japanese authorities bonds from the financial turmoil, the Japanese yen and Usa dollar sharply rose confronting other currencies, including the euro.[32] The European sovereign debt crunch that unfolded in 2010 sent the euro falling to a four-yr low of $1.1877 on June 7, as investors considered the risk that certain Eurozone members may default on their regime debt.[33] The euro's pass up in 2008-2010 had erased half of its 2000-2008 rally.[30]

Chinese-issued U.S. dollar bonds [edit]

The issuance of U.S dollar-denominated bond issued past Chinese institutions doubled to $214 billion in 2017 equally tighter domestic regulations and market place conditions saw Chinese companies look offshore to conduct their fund-raising initiatives. This has far outpaced many of the other major foreign currency bonds issued in Asia in the last few years.

The anticipated continuation of a prudent monetary policy in Prc to curb fiscal risks and nugget bubbling, along with the expectation of a stronger yuan will likely see Chinese companies to go along to issue U.S. dollar bonds.[34]

Major issuers of U.Due south. dollar denominated bonds take included Tencent Holdings Limited, Industrial and Commercial Bank of Prc Limited and Sinopec Group. In 2017, Prc'due south Ministry of Finance revealed plans to sell United states of america$2 billion worth of U.S. dollar sovereign bonds in Hong Kong, its commencement dollar bond offering since October 2004.[35] The technology and communications sector in Prc is a taking significant share of the offshore U.Due south. dollar bail marketplace. Tencent priced $5 billion of notes in Jan 2018 as a string of Asian technology firms connected to result debt as market values swelled.[36]

U.S dollar-denominated bond issued by Chinese institutions has also been referred to as 'Kungfu bonds',[37] a name born out of a consultation with more than 400 marketplace participants across Asia past Bloomberg L.P.[38] [39]

Meet as well [edit]

- Reserve currency

- Dollarization and Dedollarisation

- Internationalization of the renminbi

- International status and usage of the euro

- Listing of the largest trading partners of the United States

References [edit]

- ^ "The Decease of Cash? Non So Fast: Need for U.Due south. Currency at Dwelling house and Abroad, 1990-2016" (PDF). www.econstor.eu/. 2017-05-25. p. 8. Retrieved 2017-05-25 .

- ^ a b Kowalski, Chuck (February 11, 2020). "Impact of the Dollar on Bolt Prices". The Balance.

- ^ Babones, Salvatore (Apr 30, 2017). "'The Silver Manner' Explains How the Old Mexican Dollar Changed the World". The National Interest.

- ^ Eichengreen, Barry; Flandreau, Marc (2009). "The rise and fall of the dollar (or when did the dollar replace sterling as the leading reserve currency?)". European Review of Economic History. xiii (3): 377–411. doi:10.1017/S1361491609990153. ISSN 1474-0044. S2CID 154773110.

- ^ Amadeo, Kimberly (September iii, 2020). "How a 1944 Agreement Created a New World Order". The Balance.

- ^ "Major foreign holders of U.Southward. treasury securities 2021". Statista.

- ^ "SWIFT oversight". SWIFT - The global provider of secure financial messaging services.

- ^ "Sanctions Programs and State Data". U.S. Section of the Treasury.

- ^ "Mainland china, U.S. should adjust approach to economical growth". English.people.com.cn. 2005-12-26. Retrieved 2010-08-24 .

- ^ Evans-Pritchard, Ambrose (2007-08-08). "China threatens 'nuclear option' of dollar sales". The Daily Telegraph. London. Archived from the original on 2007-08-09. Retrieved September 26, 2007.

- ^ Chris Buckley (2008-09-17). "Cathay paper urges new currency order after "fiscal seismic sea wave"". Reuters . Retrieved 2009-09-18 .

- ^ "Reuters". Euro could replace dollar as top currency - Greenspan. 2007-09-17. Retrieved September 17, 2007.

- ^ For 1995–99, 2006–20: "Currency Composition of Official Foreign Exchange Reserves (COFER)". Washington, DC: International Budgetary Fund. May 22, 2021.

- ^ For 1999–2005: International Relations Commission Task Force on Accumulation of Foreign Reserves (February 2006), The Accumulation of Foreign Reserves (PDF), Occasional Paper Serial, Nr. 43, Frankfurt am Master: European Primal Bank, ISSN 1607-1484 ISSN 1725-6534 (online).

- ^ Review of the International Role of the Euro (PDF), Frankfurt am Master: European Central Bank, December 2005, ISSN 1725-2210 ISSN 1725-6593 (online).

- ^ Chen, James (May 17, 2021). "Dollar Bond". Investopedia.

- ^ "The dollar'south international role: An "exorbitant privilege"?". 30 Nov 2001.

- ^ a b "The ICE U.Southward. Dollar Index® and U.s. Dollar Alphabetize Futures Contracts U.s. Dollar Index" (PDF). June 2012. p. 2. Retrieved 5 October 2012.

- ^ "Introduction of the US dollar on Bonaire, St Eustatius and Saba". sxmislandtime.com. 26 May 2010. Retrieved 2010-10-22 .

- ^ "US dollar introduced in Dutch Caribbean islands". Radio Netherlands Worldwide. 1 Jan 2011. Retrieved 2011-01-02 .

- ^ "Kuwait pegs dinar to basket of currencies". Forbes. 2007-05-xx. Archived from the original on November x, 2007. Retrieved 2007-06-06 .

- ^ Rogers, Tim (May 13, 2014). "Nicaragua seeks to de-dollarize economic system". The Nicaragua Dispatch.

- ^ "New substitution rate volition make Belarusian exports competitive, NBRB vows". State Customs Committee of the Democracy of Belarus. 2009-01-06. Archived from the original on 2012-03-23. Retrieved 2009-01-24 .

- ^ "Belorussian rouble falls sharply in value". BBC News. 2011-09-14.

- ^ Chinese University of Hong Kong. "Historical Exchange Rate Regime of Asian Countries: Cambodia". Archived from the original on 2006-12-08. Retrieved 2007-02-21 .

- ^ Kurt Schuler. "Tables of Modern Monetary History: Asia". Archived from the original on 2007-02-19. Retrieved 2007-02-21 .

The U.S. dollar also circulates freely

- ^ "Taliban bans foreign currencies in Afghanistan". BBC News. 3 November 2021.

- ^ "ECB: euro exchange rates USD". Ecb.int. Retrieved 2010-08-24 .

- ^ "Dollar Falls to Record Low Versus Euro as Fed Signals Rate Cuts". Bloomberg. 2008-03-01.

- ^ a b Worrachate, Anchalee; Seki, Yasuhiko (2008-06-01). "Euro Weakens on Concerns Over Europe Spending Cuts". Bloomberg.

- ^ "Oil Rises to Record on Weakening Dollar, Morgan Stanley Outlook". Bloomberg. 2008-06-06.

- ^ David Gaffen (2008-10-22). "Somehow, the Dollar Regains Safe-Haven Status". The Wall Street Journal . Retrieved October 22, 2008.

- ^ Levisohn, Ben; Worrachate, Anchalee (2008-06-ten). "Euro Climbs Almost Versus Dollar in Two Weeks on Outlook for Global Growth". Bloomberg.

- ^ Li Xiang (2018-01-03). "Sales of bonds await set to ascent this yr". Communist china Daily . Retrieved 2018-11-27 .

- ^ Karen Yeung (2017-ten-11). "China to sell kickoff dollar bond in 13 years in Hong Kong to set benchmark for Chinese issuers". South Communist china Morn Mail . Retrieved 2018-11-27 .

- ^ Manju Dalal (2018-01-12). "Tencent Joins Asia-Tech Debt Rush With Its Biggest Bail Sale". The Wall Street Journal . Retrieved 2018-11-27 .

- ^ Ishika Mookerjee (2018-04-04). "'Kung Fu' bonds grab investor attention". Citywire Asia . Retrieved 2018-11-27 .

- ^ Ee Chuan Ng (2018-04-thirteen). "'Gongfu bonds get bright spot with Asian investors every bit Chinese US$ bonds take off". The Business organization Times . Retrieved 2018-11-27 .

- ^ Vicky Wei, Andrew Cheung, Wenwen Zhang (2018-04-nineteen). "'Baidu, Tencent sales give Kungfu bonds a hi-tech boot in 2018". Bloomberg Professional Services . Retrieved 2018-xi-27 .

{{cite news}}: CS1 maint: multiple names: authors listing (link)

Source: https://en.wikipedia.org/wiki/International_use_of_the_U.S._dollar

Posted by: cooperournisid.blogspot.com

0 Response to "Where Is American Money With The Most?"

Post a Comment